March 8, 2023

Dear Reader,

We hope this finds you well.

We’ve got a red-hot Nasdaq profile to share with you this morning.

Charge Enterprises (CRGE)

Charge Enterprises focuses on connecting people everywhere with communications and electric vehicle charging infrastructure. And right now, there are five potential catalysts that could catapult this profile, near-term. Here’s what you need to know.

No. 1 – Charge Enterprises has a low float volatility

No. 2 – Analysts recently initiated a buy rating on the stock, with a $4.50 price target

No. 3 – Charge Enterprises’ is seeing solid earnings growth.

No. 4 – Major automaker rollouts of EV charging stations represents a significant opportunity.

No. 5 – Demand in Charge’s addressable market are being driven by the U.S. government’s approval of the Electric Vehicle Infrastructure Deployment Plan, as well as mandates in California and New York for all new vehicle zero-emission purchases in 2035.

But more on those in just a moment…

About CRGE: An Electrifying Opportunity

Charge Enterprises focuses on connecting people everywhere with communications and electric vehicle charging infrastructure. Its telecom business provides routing of both voice and data to carriers and mobile network operators. Most exciting is the company’s infrastructure business, which is focused on electric vehicle charging.

Charge plans to deploy a multi-phased strategy, initially where investment in the EV charging revolution is taking place, the nation’s approximately 18,000 franchised auto dealers. Starting with the largest automotive OEMs, their dealers, and their fleets, its goal is to capture a significant portion of these retail dealerships – creating a dealer ecosystem that will lead to repeat customers and recurring revenue. Complimenting this strategy will be the acquisition of strategic infrastructure entities that will provide cash flow, skill teams and knowledge to enhance the buildout of our EV infrastructure strategy.

A Potential Blockbuster Opportunity

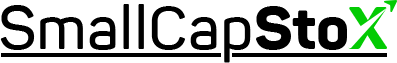

Significant Market Opportunity: The number of charge points in the US is poised to grow from about 4 million today to an estimated 35 million in 2030, according to PwC. The at-work and on-the-go EV charging segments are potentially the fastest growing through 2030.

EV Infrastructure Market: The EV charging market could grow to $100 billion by 2040, fueled in part by the new infrastructure bill that aims to add 500,000 EV chargers by 2030. Charge CEO Andrew Fox says CRGE could be a “huge beneficiary when that happens.”

U.S. Opportunity: A big area for Charge is building out its services at car dealerships, which number around 18,000 across the country.

Experienced, Solid Management Team: Experienced management team with more than 150 years of combined direct OEM work. The team has strong relationships with OEMs and dealerships, where significant private investment is taking place.

Attractive Valuation: Its current valuation, coupled with strong catalysts, holds significant upside potential.

Moments ago, we mentioned CRGE has five potentially electrifying catalysts.

Here’s more on each of them.

No. 1 — Charge Enterprises has a low float volatility

According to Yahoo Finance, Charge Enterprises has a low float of approx. 95.5 million shares.

That’s important because of volatility. Further solid news for the CRGE stock could provide the spark this low float stock needs for further upside.

No. 2 – Analysts recently initiated a buy rating on the stock, with a $4.50 price target

H.C. Wainwright analyst Amit Dayal initiated a Buy rating and $4.50 price target. The analyst views the company as an attractively valued provider of technology and infrastructure solutions, as noted by TheFly.com. The analyst believes the drop in the company’s stock has been driven more by prevailing market weakness rather than operational execution.

No. 3 — Charge Enterprises’ is seeing solid earnings growth

In its third quarter, the company reported revenues of $185.9 million, compared with $117.0 million in the third quarter of 2021. Gross profit for the third quarter of 2022 increased to $6.9 million, compared with $3.9 million in the third quarter of 2021.

In its infrastructure segment, the company said revenue increased $16.9 million, and proforma revenues increased $9.2 million, compared with the third quarter of 2021. The more than doubling in reported revenues was due to the Company’s acquisitions of BW and EV Depot and organic growth in ANS and the Company’s EV charging business. The 52% increase in proforma revenues demonstrates the continued success of the Company’s strategy to drive organic growth across the Company’s Infrastructure business.

No. 4 – Major automaker rollouts of EV charging stations represents a significant opportunity

The number of charge points in the US could grow from about 4 million today to an estimated 35 million in 2030. The electric vehicle supply equipment (EVSE) market could grow from $7 billion today to $100 billion by 2040 at a 15% compound annual growth rate, according to PwC.

No. 5 – Demand in Charge’s addressable market are being driven by the U.S. government’s approval of the Electric Vehicle Infrastructure Deployment Plan, as well as mandates in California and New York for all new vehicle zero-emission purchases in 2035.

Electric transportation got a jolt of support from the 2021 Infrastructure Investment and Jobs Act — which funds $7.5 billion in EV charging infrastructure. Most recently, the Inflation Reduction Act provided tax credits for both new and used electric passenger vehicles as well as for commercial vehicles, and California announced it will ban the sale of new internal combustion engine-powered vehicles by 2035.

CRGE Recap – Five Potential Catalysts for this NASDAQ Profile

No. 1 – Charge Enterprises has a low float volatility

No. 2 – Analysts recently initiated a buy rating on the stock, with a $4.50 price target

No. 3 – Charge Enterprises’ is seeing solid earnings growth.

No. 4 – Major automaker rollouts of EV charging stations represents a significant opportunity.

No. 5 – Demand in Charge’s addressable market are being driven by the U.S. government’s approval of the Electric Vehicle Infrastructure Deployment Plan, as well as mandates in California and New York for all new vehicle zero-emission purchases in 2035.

In short, get CRGE on your radar screen now.

Copyright – 2023 Small Cap Stox All rights reserved. Disclaimer and Privacy Policy For more Information please contact info@smallcapstox.com

ALL STOCK ALERTS ARE COMPENSATED BY EITHER A THIRD PARTY OR THE ISSUER OF THE SECURITY. PLEASE READ THE INDIVIDUAL DISCLAIMER WHEN ANY COMMUNICATION MENTIONS AS SPECIFIC SECURITY.

SmallCapStox.com has not been compensated for this report on Charge Enterprises (Nasdaq: CRGE).

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Third Party Pixels and Cookies

When you visit our website, log in, register or open an email, cookies, ad beacons, and similar technologies may be used by our online data partners or vendors to associate these activities with information they or others have about you, including your email address. We (or service providers on our behalf) may then send communications and marketing to these email addresses.