Sponsored – Est. 9 Min Read

Blockbuster Biotech Opportunity:

Under-the-Radar Company’s Treatment Sees Impressive Results; Fast-Tracked by FDA

Early investors in BriaCell Therapeutics Corp. (Nasdaq: BCTX) could see explosive upside potential

Analyst Emily Bodnar of H.C. Wainright & Co. is covering BriaCell Therapeutics Corp. (Nasdaq: BCTX) and has recently updated the company outlook. Additional information – including an intriguing price target for the stock – can be viewed by clicking here.

Breaking News

BriaCell Therapeutics Receives Buy Rating from Analyst – Read More…

Featured Webcast

Dedicated to enhancing the lives of people with cancer with limited therapy options by developing novel immunotherapies to fight cancer. Immunotherapies have become the forefront of the cancer treatments because they use the body’s immune system to destroy cancer cells, offer the potential for higher levels of safety and efficacy than chemotherapy, and may also prevent cancer recurrence.

Dr. William Williams M.D., CEO – Listen Now…

A significant medical breakthrough is sorely needed in the fight against breast cancer.

According to the American Cancer Society, more than 3.1 million women in the United States have a history of invasive breast cancer.

And breast cancer deaths are estimated to be more than 43,000 per year – making it the second leading cause of cancer death in women.

But there may be hope on the way in the near future.

One under-the-radar company, whose lead drug candidate was awarded Fast Track status by the FDA, appears to be on the verge of a massive disruption in cancer treatment.

That company is BriaCell Therapeutics Corp. (Nasdaq: BCTX), a clinical stage immunotherapy company developing treatments that boost the ability of the body’s own cancer-fighting cells to destroy cancerous tumors.

And they’re getting impressive results.

BriaCell Therapeutics Corp.’s mission is to develop novel immunotherapies to fight cancer. The company is dedicated to enhancing the lives of women with breast cancer who have limited therapy options.

Immunotherapies use the body’s own immune system to destroy cancer cells while offering the potential for higher levels of safety and efficacy than chemotherapy; and may also prevent cancer recurrence.

The company’s patented immunotherapy treatments have shown extraordinary potential, making it one of the more attractive high-upside biotech stocks for investors to consider in 2023.

Breast Cancer: Facts & Statistics

- According to a report published by the American Cancer Society in 2023, approximately 609,820 Americans are expected to die from cancer in 2023 (approximately 1,670 deaths per day), making cancer the second leading cause of death in the U.S., exceeded only by heart disease.

- As of January 2023, the number of women in the U.S. with a history of invasive breast cancer is estimated to be 3.1 million (excluding the estimated 284,200 new cases in 2023). This number is expected to increase by 12% to 4 million in 2024. Approximately 30% of breast cancers occur in women younger than age 50 and 44% occur in women older than age 65.

- According to an American Cancer Society in 2023 fact sheet, 297,790 women and 2,800 men are expected to be diagnosed with invasive breast cancer in 2023 in the U.S. alone. Breast cancer is the most frequently-diagnosed cancer in women in the U.S.

- Breast cancer deaths in 2023 are estimated to be 43,700 (43,170 women, 530 men), making breast cancer the second leading cause of cancer death in women (after lung cancer).

- As reported by the American Cancer Society in 2023, approximately 62% of breast cancer cases are detected at the early stages (i.e., the cancer is found in the breast tissue, and has not spread to lymph nodes or other regions of the body), for which the 5-year survival rate is estimated to be 99%. As soon as the cancer spreads to lymph nodes under the arm or nearby tissues (regional stage), the 5-year survival rate drops to 85%. However, once the cancer spreads to other lymph nodes or body parts (distant stage or metastatic cancer), the 5-year survival rate falls to as low as 27% (i.e. 73% of the patients die within 5 years). This shows the significant need for effective treatments for this deadly cancer.

6 Key Reasons Why BriaCell Therapeutics Corp. (Nasdaq: BCTX) Appears to Offer

Explosive Upside Potential in 2023

Key Reason #1: The company’s lead drug candidate, Bria-IMT™, has shown extraordinary potential to date and is advancing rapidly.

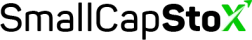

The company’s lead drug candidate, Bria-IMT™, was developed and characterized by a team of dedicated scientists and clinicians as a targeted immunotherapy being developed for the treatment of advanced breast cancer.

Specifically, Bria-IMT™ is targeting advanced metastatic breast cancer – the cause of over 40,000 deaths per year in the U.S.

Bria-IMT™ was awarded Fast Track designation by the FDA. The Fast Track process is designed to, as the FDA puts it, “facilitate the development, and expedite the review of drugs to treat serious conditions and fill an unmet medical need.”

In other words, it’s a way to get important new drugs reviewed and approved much faster…which can mean good news for patients as well as prospective investors.

About Bria-IMT™

- Bria-IMT™ is a genetically engineered human breast cancer cell line with features of immune cells and is clinically used as a targeted immunotherapy.

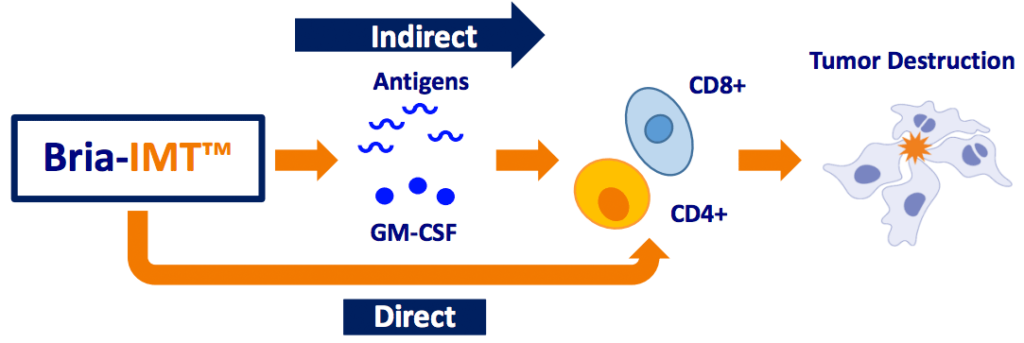

- Over four dozen patients treated to-date show robust responses to the treatment in selected sub-groups.

- And the Phase I/IIa safety and efficacy study shows similar or superior results to other advanced or approved drugs when they were at a comparable stage.

- Bria-IMT™ is now being tried in Part II of a Phase I/II trial in combination with immune checkpoint inhibitors.

Positive feedback from End of Phase II Meeting with FDA

In January 2023, BriaCell Therapeutics announced that it had received agreement and positive feedback from its End of Phase II meeting with the FDA regarding BriaCell’s lead clinical candidate, Bria-IMT™ in combination with a checkpoint inhibitor (under Fast Track designation), in advanced metastatic breast cancer.

BriaCell and the FDA have agreed on the primary end point – linked to patient survival – the essential elements of the study design, and the type of patients to be enrolled in BriaCell’s upcoming pivotal clinical study.

This pivotal registration study will be enrolling advanced metastatic breast cancer patients for whom no approved treatment options exist. Patient dosing should be able to start in the summer of 2023.

Moving directly into a pivotal study shortly after receiving Fast Track status has greatly advanced BriaCell’s lead clinical program timetable with the ultimate goal of commercializing its novel immunotherapy approach for women with no approved treatment options.

Combination regimen with Keytruda® shows positive results

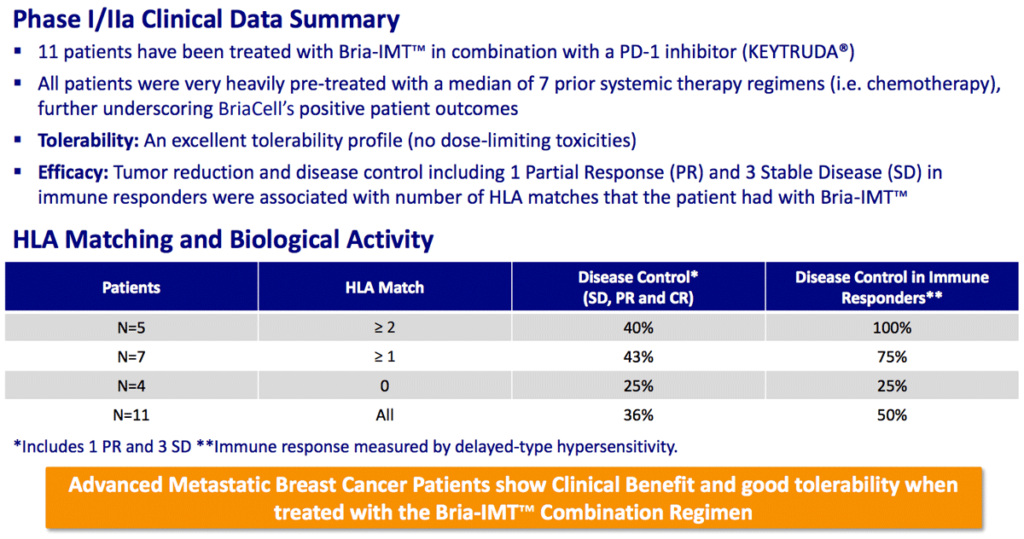

70% of patients show positive results in combination with Incyte’s retifanlimab

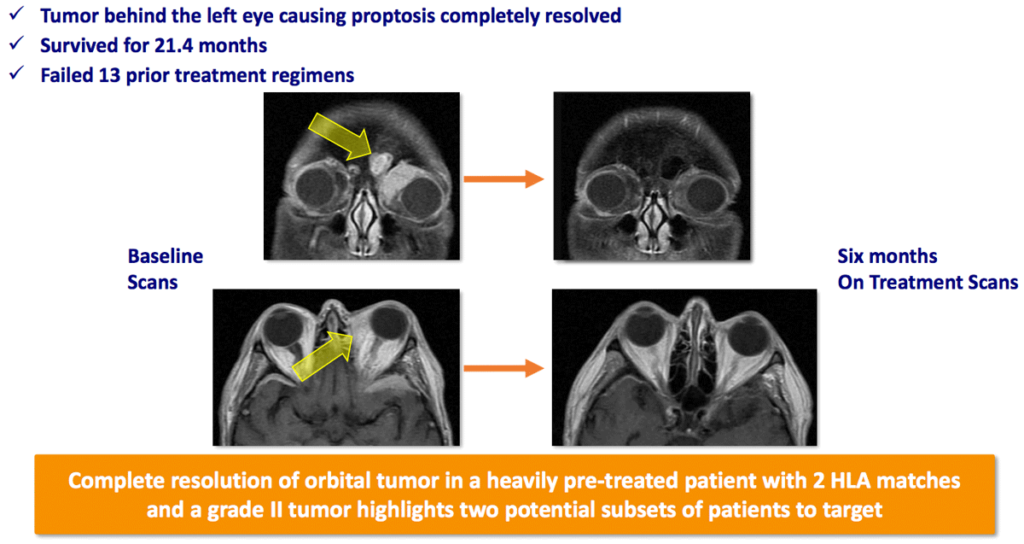

One of the more remarkable results seen to date with Bria-IMT™ and retifanlimab showed the efficacy of the treatment in metastasis behind the patient’s eye, with a complete resolution of the tumor.

Key Reason #2: BriaCell’s collaboration agreement with Incyte Corporation (Nasdaq: INCY).

BriaCell Therapeutics Corp. (Nasdaq: BCTX) enjoys a corporate collaboration and supply agreement with Incyte Corporation (Nasdaq: INCY).

Incyte Corporation is a massive, $16 billion market cap biopharmaceutical company with a history of developing – and acquiring – successful treatments and therapies.

BriaCell’s agreement with Incyte is focused on the selection of novel combinations for the treatment of advanced breast cancer along with the ongoing clinical study of BriaCell’s lead candidate, Bria-IMT™, with Incyte’s retifanlimab (Zynyz) for advanced breast cancer. Note that Zynyz was recently approved for the treatment of urothelial cancer.

As part of this agreement, BriaCell is evaluating combinations of novel therapeutics for the treatment of patients with advanced breast cancer. Incyte provides BriaCell with Zynyz in the ongoing combination study with Bria-IMT™.

The ongoing randomized Phase II trial of Bria-IMT™ plus Incyte’s retifanlimab has shown impressive results.

Of 12 patients recently tested, 70% showed either disease control or progression-free survival benefits vs. the last therapy used. And “better quality of life” and “less pain” were reported by many gravely ill advanced metastatic breast cancer patients.

This collaboration agreement with Incyte is a tremendous positive for BriaCell not only because of the results being achieved with the combination treatments…but also because this collaboration places BriaCell firmly on the radar of larger companies such as Incyte for future collaboration or potential acquisition.

Key Reason #3: Bria-OTS™ “Off-the-Shelf Personalized” immunotherapy is another of the many impressive treatment candidates in the company’s pipeline.

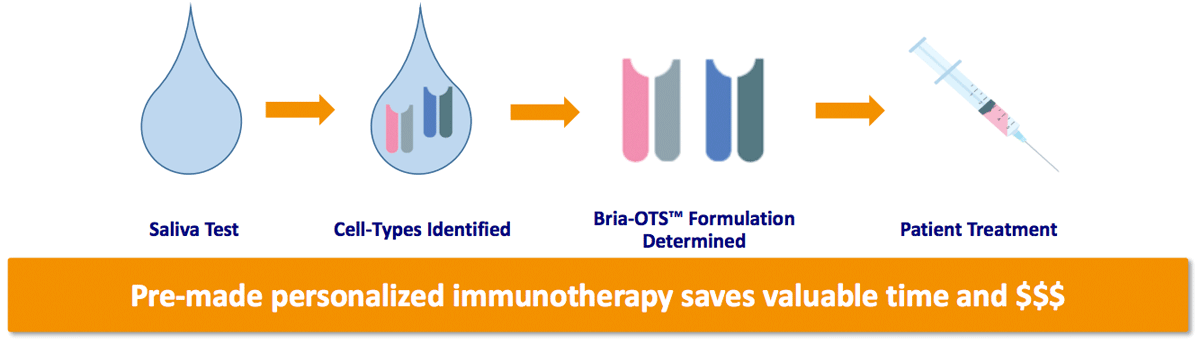

Recently awarded a patent by the USPTO, BriaCell is developing Bria-OTS™, the first “off-the-shelf” personalized immunotherapy for the treatment for advanced stage breast cancer.

Collaborating with the National Cancer Institute (part of NIH), the company believes its cellular immunotherapy is most effective when the patient’s HLA-type matches the Bria-IMT™ HLA-type.

BriaCell is engineering 15 unique HLA types (molecules) into four Bria-OTS™ cell lines, allowing for matching of over 99% of patients with advanced breast cancer.

This obviously greatly expands the potential market for the treatment, and BriaCell eventually plans to expand the technology behind Bria-OTS™ to different cancer types, with platform potential.

BriaCell expects to file an IND in the first half of 2023, and clinical studies should begin shortly after IND clearance. The company then expects to begin dosing patients with advanced metastatic breast cancer in a Phase I/II clinical trial in 2023.

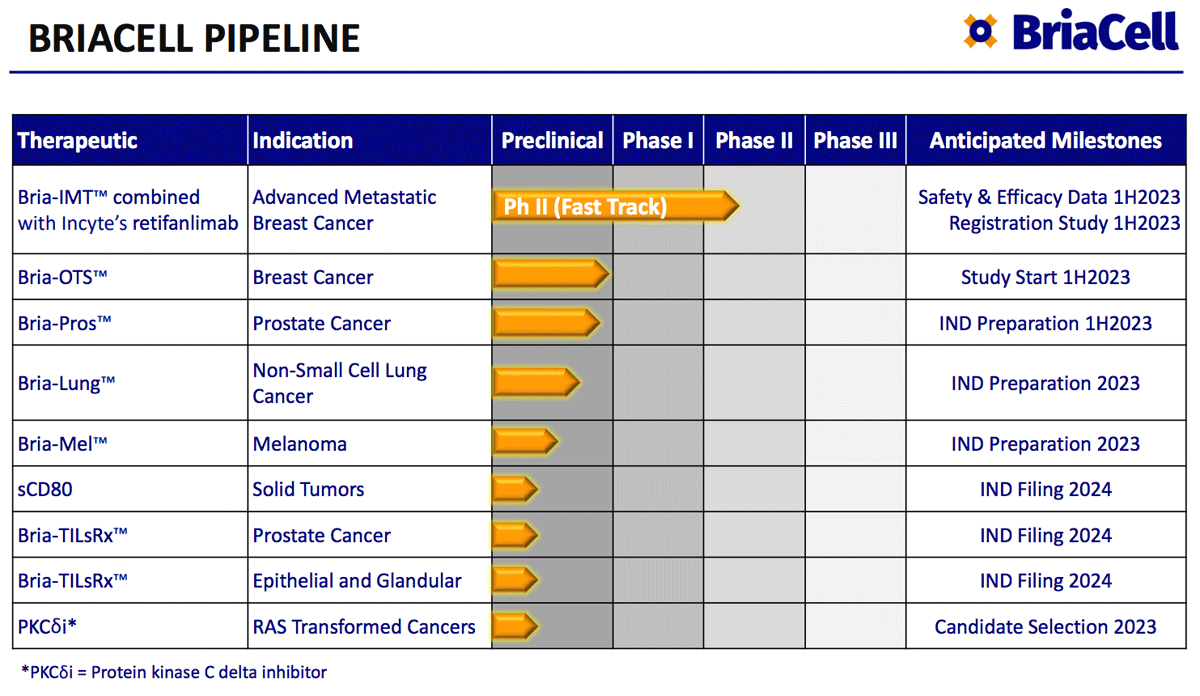

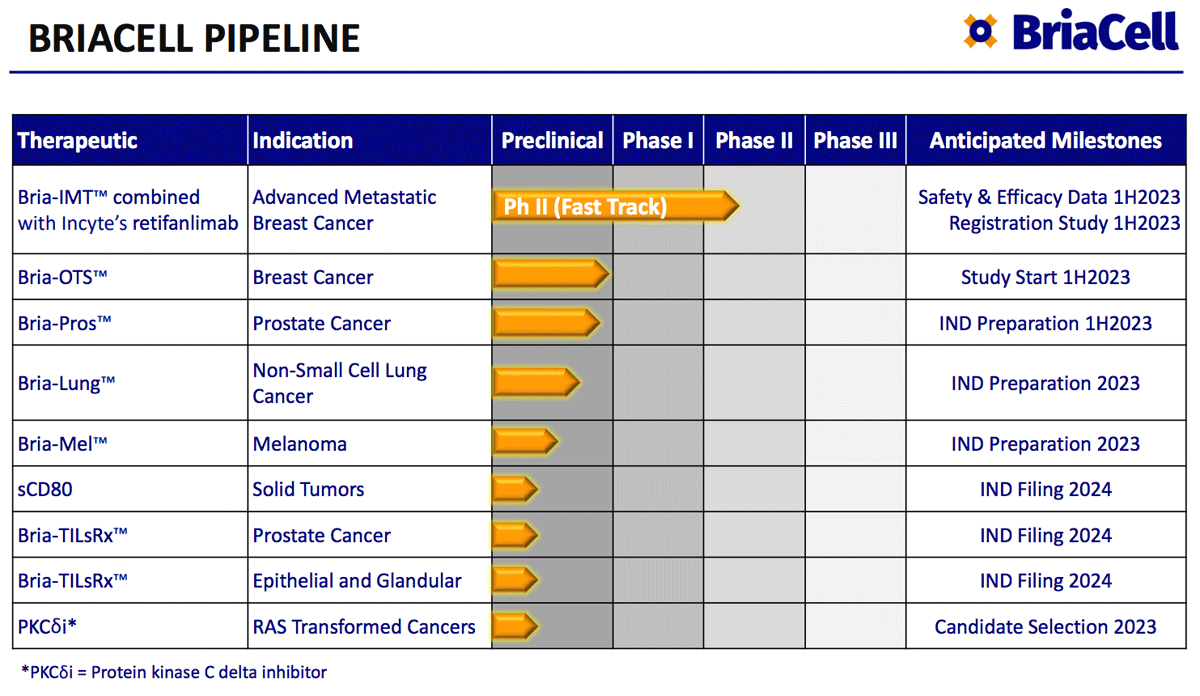

While BriaCell’s focus to date has primarily been on Bria-IMT™ and Bria-OTS™, the company has a robust pipeline of additional drug candidates including potential treatments for melanoma, lung cancer and prostate cancer among others.

Key Reason #4: The biotech market can offer investors the potential to create outsized fortunes.

The biotech sector is one of the most intriguing areas of the market for profit-seekers, as the potential exists for both small and large companies to skyrocket in value.

Thanks to modern technology and innovation, new ways to treat and prevent diseases are being created that are not only saving lives…but also creating massive profit opportunities.

In 2022 alone, a number of biopharma stocks delivered triple-digit gains, including:

- Rhythm Pharmaceuticals, Inc. (Nasdaq: RYTM) – this developer of therapeutics for treatment of rare genetic diseases of obesity soared 192% in 2022.

- Madrigal Pharmaceuticals, Inc. (Nasdaq: MDGL) – this clinical-stage biopharmaceutical company saw its shares skyrocket 243% in 2022. It’s worth highlighting that Madrigal’s Founder and Chief Medical Officer Rebecca Taub, M.D. is on BriaCell’s board of directors.

- And Verona Pharma (Nasdaq: VRNA) – this developer of treatments for respiratory diseases vaulted 289% in 2022!

“The hunger for replenished pipelines and maturing products means many of the companies on big pharma’s shopping list could continue to outperform. Betting on a basket of probable targets as deal making heats up still makes a lot of sense.”

The potential to make a significant impact on a large population through novel treatments or vaccines is what makes the biotech sector so attractive to investors.

Few sectors can offer such promising prospects for exponential growth and significant returns.

Today, BriaCell Therapeutics Corp. (Nasdaq: BCTX) offers investors one of the best ways to play the biotech market for maximum upside potential.

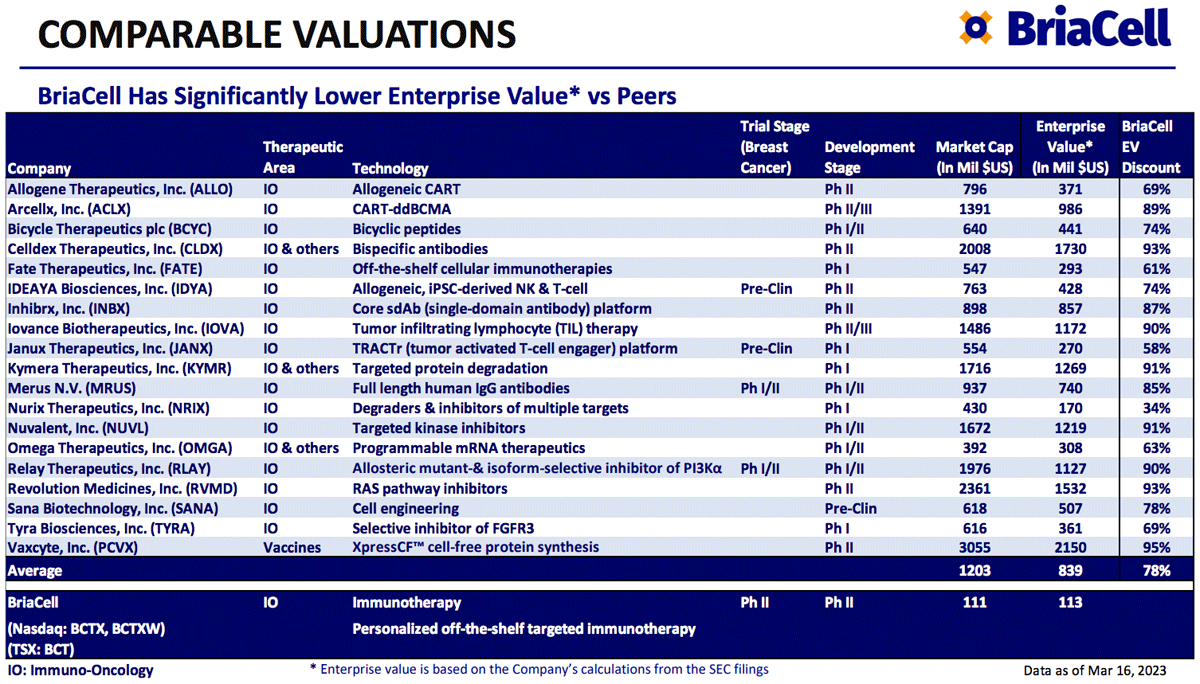

Key Reason #5: BriaCell appears to be significantly undervalued when compared to its peers.

The potential for rapid growth in valuation is higher in the biotech sector than perhaps any other.

Part of the reason why this potential exists is that often companies – even those with impressive treatments – can fly under Wall Street’s radar for an extended period of time.

In the case of BriaCell Therapeutics Corp. (Nasdaq: BCTX), investors considering the company today are looking at a company with a market capitalization just a fraction of that seen by its closest peers in the biotech space.

Take Allogene Therapeutics, Inc. (Nasdaq: ALLO), for example. Allogene is a clinical stage immuno-oncology company that develops and commercializes genetically engineered allogeneic T cell therapies for the treatment of cancer.

Allogene Therapeutics has a similar number of treatments in its pipeline – with two in Phase II clinical trials – yet has a market cap more than six times greater than BriaCell Therapeutics.

The same goes for other peers, including Fate Therapeutics, Inc. (Nasdaq: FATE) with a market cap roughly five times greater than BriaCell’s…and Sana Biotechnology, Inc. (Nasdaq: SANA) with a market cap six times greater than that of BriaCell.

As BriaCell Therapeutics continues to advance – and show strong results with its trials – it will gain an increasing amount of attention, increasing the likelihood of a surge in valuation and attracting the attention of larger biotech companies looking for potential buyout candidates.

An objective comparison of the company – and its current market cap – to its peers shows that, given the success the company has already demonstrated, BriaCell Therapeutics offers investors the potential for significant upside in the months ahead.

Key Reason #6: BriaCell Therapeutics Corp. is led by an expert drug development and financial team.

One of the most important keys to success when evaluating the potential for any biotech investment is the leadership team running the company.

Simply put, if the leadership team lacks experience in drug development…the chances for success are not great.

In the case of BriaCell Therapeutics Corp. (Nasdaq: BCTX), it’s important to note that the company’s clinical strategy team has been involved in 19 drug approvals.

The company’s President and CEO, Dr. William Williams is widely recognized as one of the foremost experts in drug development, with 11 successful new drug applications and approvals with the FDA and other regulatory agencies.

William V. Williams, MD, FACP – President and Chief Executive Officer

Dr. Williams is a seasoned biopharmaceutical executive with over 35 years of industry and academic expertise, including significant clinical management in multinational pharmaceutical companies. Dr. Williams has served as BriaCell’s President & CEO since Nov 2016.

Giuseppe Del Priore, MD, MPH – Chief Medical Officer

Dr. Del Priore is a seasoned healthcare executive with over 25 years of experience in research, drug development, and clinical trials management. Dr. Del Priore’s prior work experience includes serving as a biotech Chief Medical Officer, a National Director at the Cancer Treatment Centers of America (CTCA), plus faculty at Indiana University School of Medicine, Weill Cornell Medicine, and New York University School of Medicine. He has been involved in 8 drug or device approvals.

Miguel A. Lopez-Lago, PhD – Chief Scientific Officer

Since 2000, Dr. Lopez-Lago has been working as a cancer scientist at Memorial Sloan-Kettering Cancer Center, New York (MSKCC). Specifically, he has investigated various aspects of tumor biology, including the development of targeted therapies for Mesothelioma and the characterization of the biological mechanisms underlying cancer metastasis.

Investor’s Summary:

BriaCell Therapeutics Corp. (Nasdaq: BCTX) is a clinical stage immunotherapy company developing treatments that boost the ability of the body’s own cancer-fighting cells to destroy cancerous tumors.

The company’s patented immunotherapy treatments have shown extraordinary potential, making it one of the more attractive high-upside biotech stocks for investors to consider in 2023.

Breast Cancer: Facts & Statistics

- According to a report published by the American Cancer Society in 2023, approximately 609,820 Americans are expected to die from cancer in 2023 (approximately 1,670 deaths per day), making cancer the second leading cause of death in the U.S., exceeded only by heart disease.

- As of January 2023, the number of women in the U.S. with a history of invasive breast cancer is estimated to be 3.1 million (excluding the estimated 284,200 new cases in 2023). This number is expected to increase by 12% to 4 million in 2024. Approximately 30% of breast cancers occur in women younger than age 50 and 44% occur in women older than age 65.

- According to an American Cancer Society in 2023 fact sheet, 297,790 women and 2,800 men are expected to be diagnosed with invasive breast cancer in 2023 in the U.S. alone. Breast cancer is the most frequently-diagnosed cancer in women in the U.S.

- Breast cancer deaths in 2023 are estimated to be 43,700 (43,170 women, 530 men), making breast cancer the second leading cause of cancer death in women (after lung cancer).

- As reported by the American Cancer Society in 2023, approximately 62% of breast cancer cases are detected at the early stages (i.e., the cancer is found in the breast tissue, and has not spread to lymph nodes or other regions of the body), for which the 5-year survival rate is estimated to be 99%. As soon as the cancer spreads to lymph nodes under the arm or nearby tissues (regional stage), the 5-year survival rate drops to 85%. However, once the cancer spreads to other lymph nodes or body parts (distant stage or metastatic cancer), the 5-year survival rate falls to as low as 27% (i.e. 73% of the patients die within 5 years). This shows the significant need for effective treatments for this deadly cancer.

[1] https://www.wsj.com/articles/the-biotech-takeout-menu-gets-pricier-11670477036

Disclaimer:

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. SmallCapStox.com,owned and operated by Jade Cabbage Media, LLC makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of BriaCell Therapeutics Corp. and its securities. Jade Cabbage Media, LLC has received up to $40,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither SmallCapStox.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of BriaCell Therapeutics Corp. and do not currently intend to purchase such securities. The issuer, BriaCell Therapeutics Corp. has compensated Winning Media LLC the sum total of two hundred thousand dollars USD total production budget to manage a digital media campaign for ninety days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.